California Wildfire Insurance

FAQ's

Safeguard Your Home And Your Assets With California Wildfire Insurance

In 2021, the state of California reported 8,835 wildfires and over 2.5 million acres destroyed by the increasingly common fires that have ravaged the land and natural forests. And in fact, the 5-year average is currently 8,607 fires and just over 1.6 million acres burned. As the California climate continues to be impacted by climate change, the incidence of wildfires is growing drastically, due to extreme dryness combined with increased temperatures and lack of precipitation. California residents will continue to be dramatically impacted by the growing prevalence of wildfire activity, and it is essential to take the right steps to protect your home, your assets, and the ones you love. Here, we’ll discuss the facts surrounding wildfire insurance, and why it is one of the smartest decisions you can make to protect your assets.

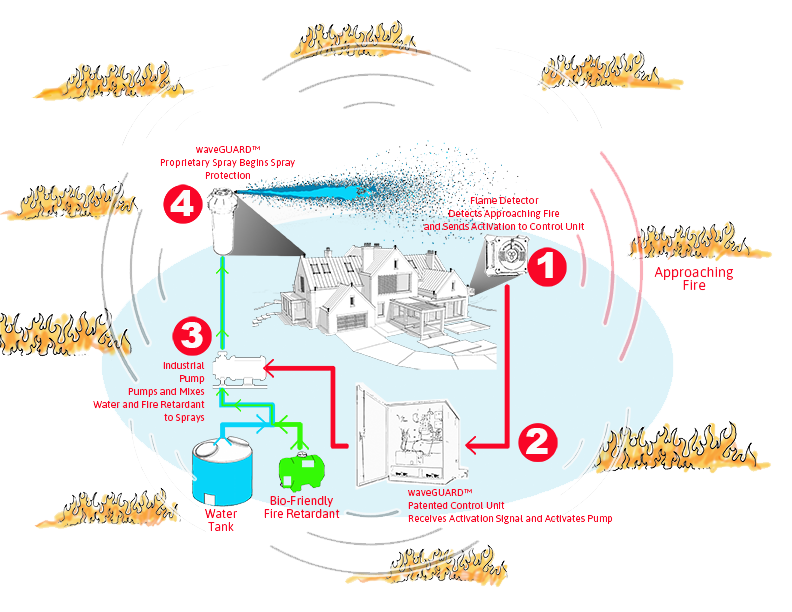

Learn how waveGUARD™ Corporation can provide you with wildfire mitigation solutions that can help protect your home in the face of impending wildfire threats. By installing equipment such as an exterior wildfire spray system, gutter guards, fire-proof vents, and applying long term fire retardant (LTR) you will not only protect your home from damage and loss, but will potentially enjoy savings on your wildfire insurance policy. Contact us today to schedule your free consultation.

*Systems located in areas which have seasons of prolonged freezing temperatures should be drained and winterized to prevent freeze damage. In some instances, heating equipment may be installed to extend operation until fire risk is low prior to winterizing. NOTE: heating equipment will increase utility usage costs significantly during use.

Are Wildfires Covered Under My Existing Homeowners Insurance Policy?

You may have previously assumed that your homeowner’s insurance policy covers wildfire damage, however, this is not always the case. It is always best to err on the side of caution and speak directly with your insurance company to ask about your current wildfire coverage, especially if you live in an area of California that regularly experiences above-average wildfire activity. As discussed above, due to the increasing year-round risk of wildfires, California homeowners are finding it difficult to purchase a homeowner’s policy that already includes coverage for wildfire-related damage or loss. Due to the present-day increased wildfire risk, many insurance companies are now forcing homeowners to purchase separate wildfire insurance, and may even prevent the renewal of your current policy if it does already contain a provision for wildfire coverage.

What Specific Coverage Is Included In A California Wildfire Insurance Plan?

Many California homeowners are now being presented with non-renewal notices for their homeowners insurance policies, or are frustrated with the struggle of finding an affordable homeowner’s policy that also contains wildfire coverage. If that is the case for you, finding an exclusive wildfire insurance policy is your best option to ensure protection and peace of mind. Although the coverage varies depending on the specific policy chosen, many California wildfire insurance plans include some or all of the following:

Dwelling Coverage

If your home is damaged directly by wildfire activity, this covers the expense of repairing your home, or building a new home if you face a total loss.

Other Structures Coverage

When considering coverage, always factor in the other structures that may also face fire damage on your property, including carports, workshops, sheds, detached garage, or an ADU.

Personal Property Coverage

This section covers the expense of replacing your personal belongings that have faced fire damage or smoke damage, and includes everything from furniture and appliances, to electronics and clothing.

Landscape Coverage

The exterior landscaping surrounding your home may be irreversibly damaged due to wildfire activity, and this coverage provides peace of mind that landscape repairs won’t come out of your own pocket.

Loss of Use Coverage

This coverage may also be presented as Additional Living Expense Coverage, and it covers expenses due to factors such as relocation during an evacuation, or short-term housing costs during repair or rebuilding of your home.

Liability Coverage

If others have been harmed or injured due to wildfire activity on your property, this section allows for coverage of medical expenses, or reimbursement for damage to the personal property of others.

These options are not inclusive of the coverage found in every wildfire insurance policy, and options can be added or excluded at the homeowner’s discretion. However, if you find that your existing homeowner’s policy does not offer protection or adequate coverage for the categories presented above, it is always a good idea to invest in a separate wildfire insurance policy that is specifically designed to protect your home, along with all associated structures and assets.

What Is The Cost Of An Exclusive California Wildfire Insurance Plan?

It’s always best to do your research to ensure you’re receiving the best wildfire insurance policy rate possible, as annual premiums and deductibles vary widely based on a variety of personal factors. The size and value of your home and surrounding property, your location, prior claims submitted, and the specific coverage options that are included in your plan all combine to form your inherent level of risk, and therefore, your ultimate wildfire insurance cost.

In general, California residents in areas that face high risk of wildfire activity will see higher deductibles – sometimes as high as $10,000 or more. Policyholders in lower-risk areas may see deductibles closer to $1,000 – $2,000.

Annual premiums have continued to rise at a rapid pace following the wildfires of 2017 and 2018. In fact, some homeowners have reported seeing an increase of 300% or more in the past several years. This expense can be reduced as much as possible by taking precautions to protect your home and property with wildfire mitigation solutions, such as installation of an exterior wildfire spray system, gutter guards, and fire-proof vents that block embers, and other preventative measures taken to proactively maintain and defend your space from fire threats.

Regardless of constantly rising insurance costs, you’ll find there are many different options out there that will provide the best possible wildfire insurance rate for your needs.

Exploring Your Best Coverage Options

As a California resident, below are the most important points to keep in mind when researching the wildfire insurance coverage options available to you.

Primary Insurance Providers

Your primary insurance provider is responsible for responding to all incidents or claims, regardless of whether you have additional policies that offer standalone coverage or not. There are several widely known primary insurers who do offer wildfire coverage, including AIG, Chubb, Cincinnati and PURE, and these companies may even have exclusive service options for homeowners in high-risk areas of California. These services may include benefits such as property evaluation to assess risk and recommend mitigation solutions, emergency response strategies, or dispatch of firefighters in the case of wildfire threat to your home or property.

Surplus Insurance Providers

If a primary insurer declines to include specific coverage options in a written policy, homeowners can turn to surplus insurance companies to receive the additional wildfire coverage they need. These standalone policies are often the only feasible option for California residents who own homes and property in areas of high risk, as many primary insurers may no longer offer dedicated wildfire policies. One well-known provider of surplus insurance policies for California residents is Lloyd’s of London.

California FAIR Plan

If you have exhausted all of your wildfire insurance options and still face a challenge in obtaining the coverage you need, you may wish to consider the California FAIR Plan, which was implemented by the state of California to meet the wildfire insurance needs of homeowners in high-risk areas. Policies written under this plan do tend to have lower costs than traditional insurance company policies, but the downside is that the coverage is subject to many more limitations and exclusions. Before submitting an application for coverage under this plan, ensure you have explored every coverage option under both primary and surplus providers, and also seek out add-on coverage options that may be available through your primary insurer.

What Should You Do If Your Insurance Policy Is Canceled or Denied Renewal?

If you’re a California resident who has been faced with a canceled insurance policy or denied insurance coverage renewal, you may be suddenly left wondering what to do. Although this is a scary situation to be in, homeowners always have a universal right to obtain wildfire coverage for their homes and personal property, regardless of their location in California. When exploring your options, these facts will help you make an informed decision about your rights to wildfire insurance coverage.

Canceled Homeowners’ Insurance Policies

Unfortunately, canceled home insurance policies are becoming more common for residents in high-risk areas, as wildfires have increasingly become a year-round threat. In recent years, California has taken steps to implement temporary bans on canceling insurance of policyholders exclusively due to increased wildfire threats. Although some of these bans have expired, there are still bans in place to prevent insurance companies from dropping coverage in some high-risk areas throughout the state. If you receive an unexpected notice of cancellation, be sure to explore your legal rights to wildfire insurance in your specific community of residence.

Non-Renewed Insurance Policies

Since wildfires have become a year-round threat throughout the state of California, many insurance companies are denying renewals to their current policyholders. Typical policies have periods of coverage ranging from 6 months to 12 months, and once a policy hits the expiration date, your insurance company may decide not to renew based on perceived policy risk. This practice is becoming more common as wildfires continue to pose a constant concern to homeowners, and if your current policy is coming up for renewal soon, it is always a good idea to keep a list of potential providers to contact if you are faced with this challenging situation. To protect your home, safeguard personal assets, and avoid gaps in coverage, having a backup list of insurance providers will be extremely helpful to avoid scrambling at the last minute.

Shop Around To Ensure You Receive The Best Possible Rate

As with any insurance policy decision, performing your own research when sourcing a wildfire insurance plan is crucial to ensure you receive the best possible rate and favorable coverage terms. Before you make a final decision, narrow your search down to providers that can meet all of your wildfire coverage needs, and then compare coverage rates from all of the providers in your local area. With research and preparation, you’ll be rewarded with a plan that fits your needs and offers the best premium and deductible rates.

Depending on the insurance provider you ultimately choose for coverage, you may be eligible for discounts or credits due to action taken on your part to safeguard your home from fire damage. For example, mitigation strategies may include installing a exterior wildfire spray system, fitting your home with fire-proof vents, and gutter guards, or even living in a community that is recognized as part of the Firewise USA program, administered by the NFPA. All of these actions are considered to be proactive measures that reduce your personal risk for damage or loss, and therefore, you may receive additional benefits that reduce the annual cost of your policy premiums as determined by your individual insurance provider.

Protect Your Most Valuable Assets and Save Money with waveGUARD™ Corporation

Now that you’ve learned the basic strategies of obtaining the best California wildfire insurance to suit your needs, you’re ready to take the essential next steps to safeguard your home from a potential tragedy. When you work with waveGUARD™ to defend your home from fire threats with proven mitigation strategies, you could receive a discount of anywhere from 5% to 25% on your premium, depending on your provider’s policy terms. Additional discounts, savings, or credits may also be available to policyholders who have coverage with one of our preferred insurance partners.

The waveGUARD™ exterior wildfire spray system has many features you’ll need and enjoy to protect your lives, your home and the possessions you love. They include:

- A patented controller, allowing the system to be autonomous, self-contained and automatic.

- Controller is self-activating and home owner need not be present.

- All water and 100% bio-friendly fire-retardant are applied to the roof and a 30’-40’ perimeter around your home simultaneously.

- There are no zones to cycle on or off.

- The Roof Cool function allows homeowners to run the system anytime day or night, bypassing the fire-retardant, raising the level of humidity and lowering the ambient temperature.

- 100% Bio-degradable fire-retardant is safe for all plant and animal life, wild or domestic. There is no messy or expensive cleanup required.

- Battery backup with optional Solar Panels for a continuous charge

With these features and more, you’ll always have increased wildfire protection anytime of the day or night!

Contact a member of the waveGUARD™ team today to learn more about our wildfire mitigation solutions, and how they can help protect your lives, your home and your most valuable assets.

*Systems located in areas which have seasons of prolonged freezing temperatures should be drained and winterized to prevent freeze damage. In some instances, heating equipment may be installed to extend operation until fire risk is low prior to winterizing. NOTE: heating equipment will increase utility usage costs significantly during use.